how to calculate tax on uber income

Doing the math for a 40-hour work week thats 1214. The tax summary available from.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

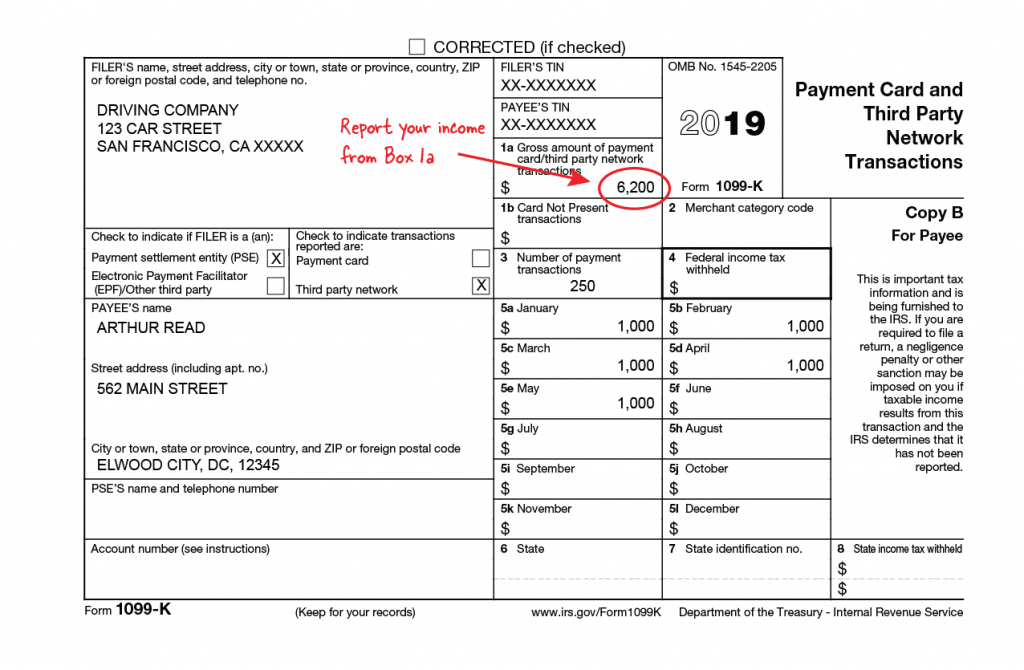

That gets put in the income section of Schedule C.

. Can Uber drivers deduct 20 of their income. With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour. Uber drivers are considered self-employed in Canada otherwise known as an independent contractor.

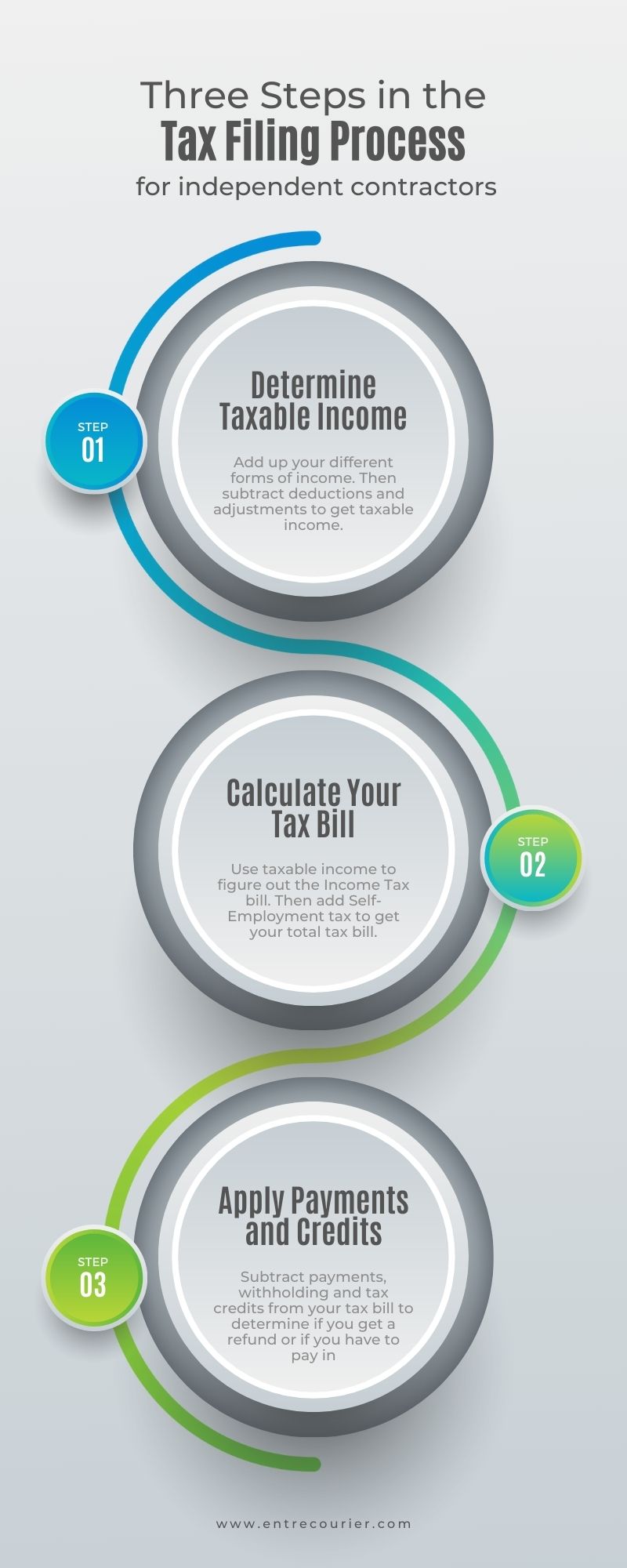

What the tax impact calculator is going to do is follow these six steps. Just add the income from both rideshare companies together and include the total on one schedule. So r t range.

The city and state where you drive for work. To use this method multiply your total business miles by the IRS Standard Mileage Rate for. Uber and Lyft Driver Income Estimator.

I think for most drivers who have other job should be over 37000. The tax summary provides a. Standard IRS Mileage Deduction.

Filter vie w s. Do I just divide by 4 to get weekly. Our calculator does all the hard work for you by.

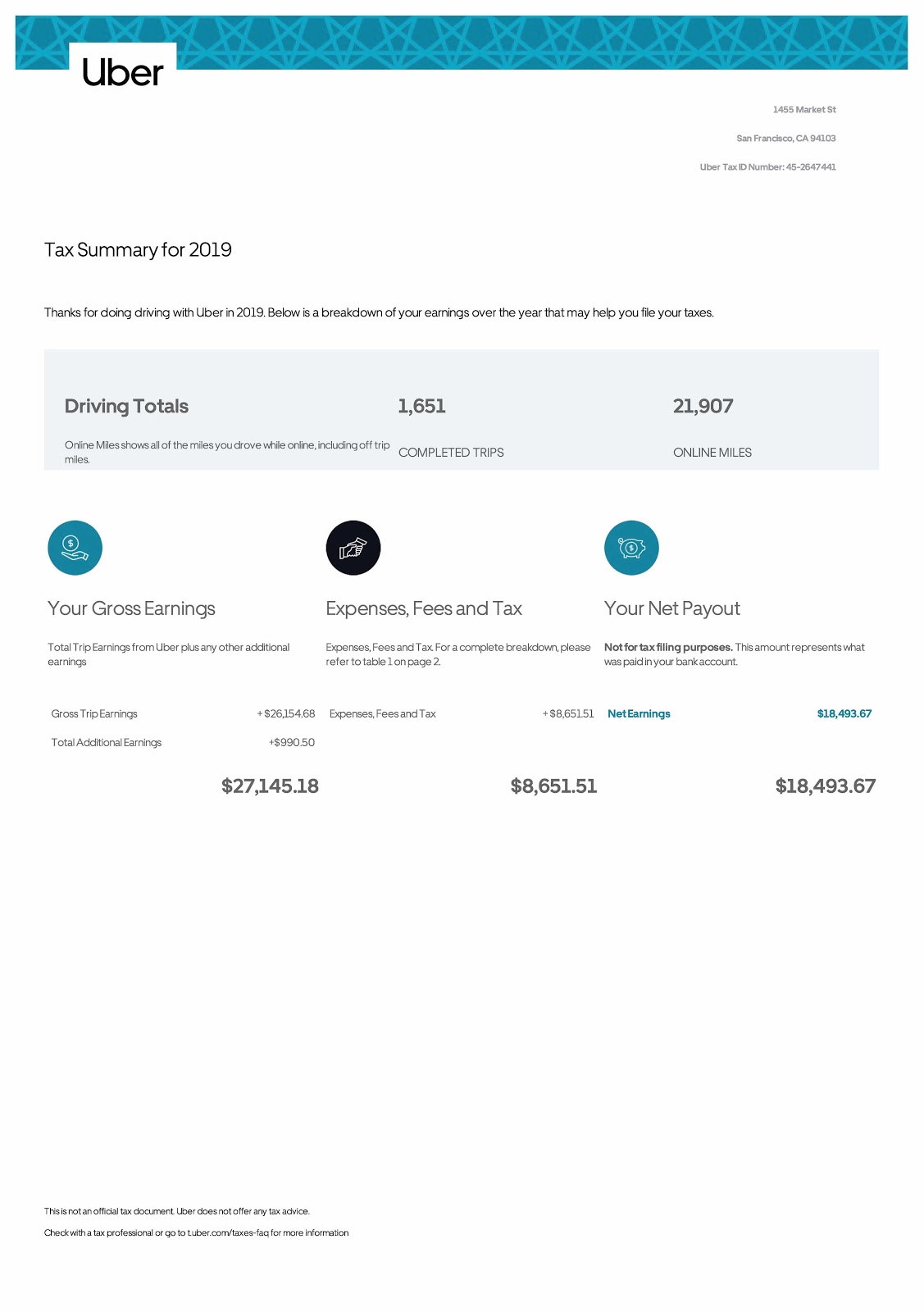

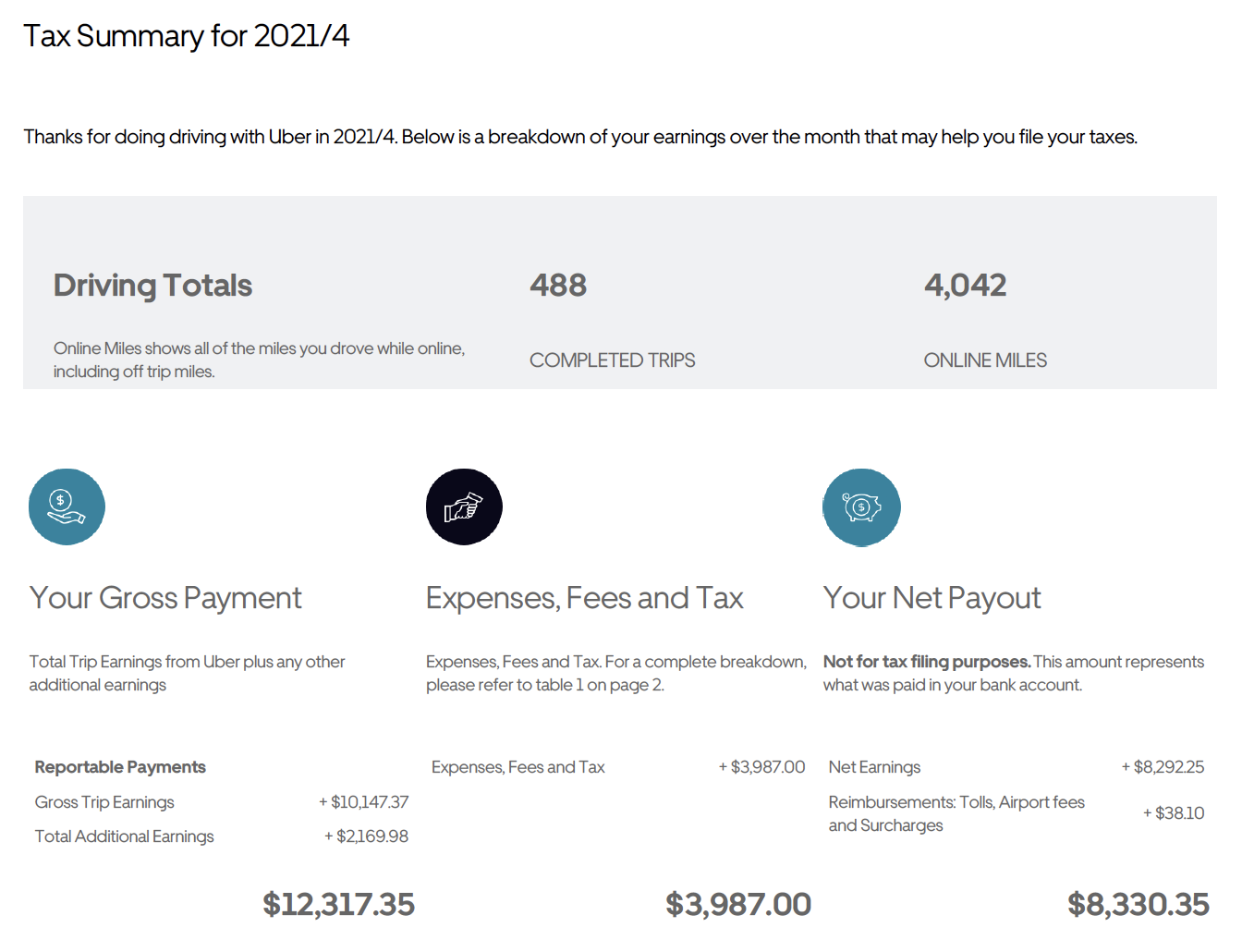

Deduct your rideshare expenses. To view the total income youve earned in a year as an Uber driver visit your Uber profile to gain access to your tax summary. This chart type is retired and cannot be edited.

For example if your taxable income after deductions is 35000 you will. Then you figure out all your. As such Uber drivers must keep records of the money they receive.

Create a f ilter. Weve made it as easy as possible for you to find out how much youll make when driving. The self-employment tax is very easy to calculate.

Once you know your taxable income after subtracting the adjustments and deductions you can proceed to calculate the tax owed. You can find tax information on your Uber profilewell provide you with a monthly and annual Tax Summary. If your annual income is over 37000 then the tax rate is 325 and you can get 675 1-325455625.

Two years of Uber employment history T2125 Tax Slips. Chart summary is disabled for charts with more than 200 rows. The average number of hours you drive per week.

Yes most Uber drivers should be able to use the Section 199A deduction to deduct up to 20 of their business income. Please provide income and Expenses to get the right calculation. All you need is the following information.

How to upload a GST Number. Its very tough to write off something like a full car payment or lease though. Your annual Tax Summary should be available around mid-July.

No highlights available for this chart. Step 1 of 2. A l ternating colors.

S ort sheet. Phone is monthly 110 total. To Calculate UBER GST using ALITAX.

18 hours agoGross Bookings of 264 billion up 35 year-over-year and above the high-end of the guidance range Net loss of 59 billion with a 56 billion headwind relating to Ubers equity. Weekly Fortnightly Monthly Quarterly. Two years of notice of assessments showing Uber income.

You can deduct car expenses like the standard mileage rate or the actual expenses. This is the easiest method and can result in a higher deduction. Your average number of rides per hour.

Estimate your business income your taxable profits. If you want to get extra fancy you can use advanced filters which will allow you to input. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it.

Can I write off my car if I drive for Uber. You simply take out 153 percent of your income and pay it towards this tax. Add a slicer J Pr o tect sheets and ranges.

This calculator is created to help uber drivers. This limit will be removed soon. C lear formatting Ctrl.

There are various ways to register for GST including completing an online application via the IRD website. You do this by adding up all your sources of income and. If you are a Uber driver applying for a mortgage you will need.

Using our Uber driver tax calculator is easy. Were not going to break down every single. If you have both a permanent job and you drive for Uber alongside this you will need to calculate the tax rate you should be paying at.

You start out by adding up your income such as from your Uber Eats 1099s or tax summary. Note you will require. UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income.

Does It Pay To Drive Uber As A Side Hustle Winning Personal Finance

Can You Claim Tax Back On The Nsw Government Levy Uber Drivers Forum

Uber Lyft Drivers How To Track Taxes Expenses Deductions Using Excel Youtube

How Do Food Delivery Couriers Pay Taxes Get It Back

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Tax Uber Calculator

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

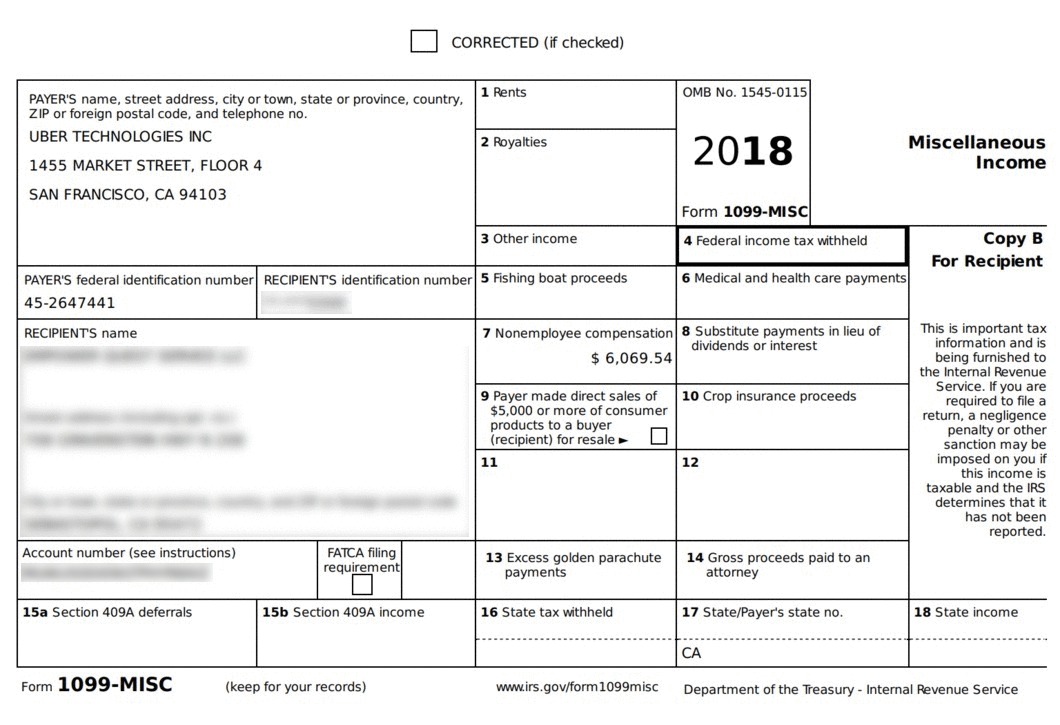

Uber Tax Forms What You Need To File Shared Economy Tax

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How Much Will I Actually Make From Uber Driving Drivetax Australia

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

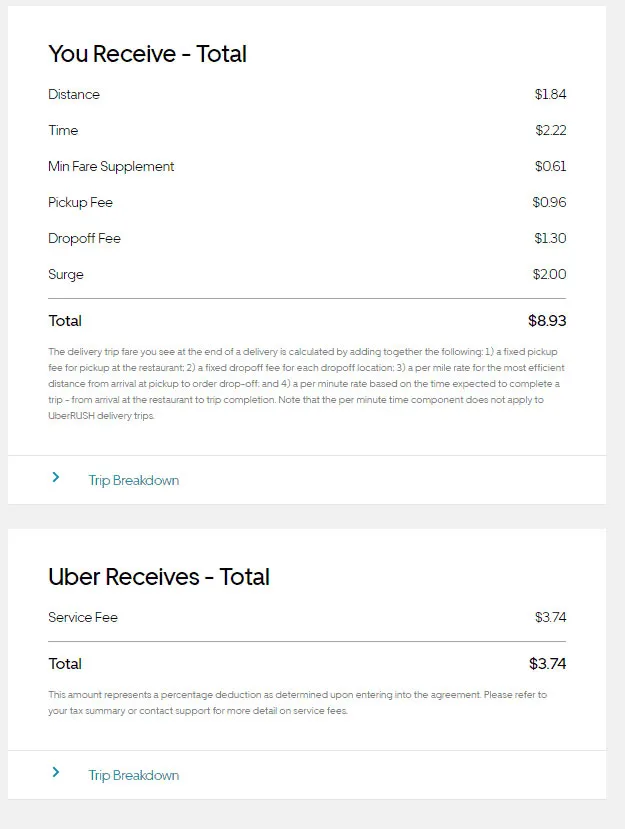

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Does It Pay To Drive Uber As A Side Hustle Winning Personal Finance

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers

Saving For Your Uber Tax Gst Bills Drivetax Australia

The Uber Lyft Driver S Guide To Taxes Bench Accounting